I recently read an article that said banks were making decisions about who to grant loans to, based on their daily spending habits. The gist is that banks look at you’re your reliance on Ubereats and Afterpay and coffee habit and make a judgement on that spending about the kind of person you are.

Look, I totally understand that rationale, especially in the economic climate we find ourselves in. And as someone who adores making judgements about people based on tiny snippets of information, I can totally get around this. However, there’s more to a purchase than just the dollar figure.

Now, I’m not in the process of applying for a home loan – even though it now feels like an actual achievable possibility since moving from stinktown Sydney – but I do wonder what a bank would think about my purchases and what they would say about me. So I’ve gone through and had a quiz at my weekend spendings with a view to working out what someone would deduce about me as a person based on my purchases.

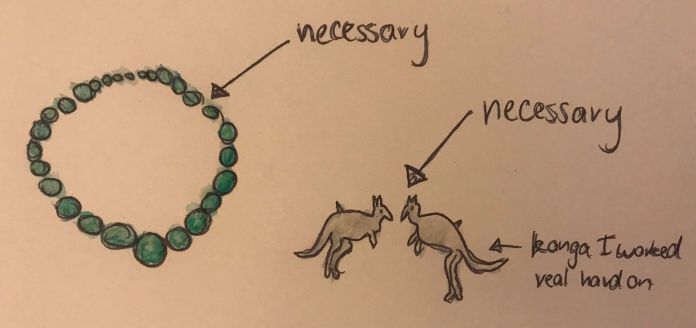

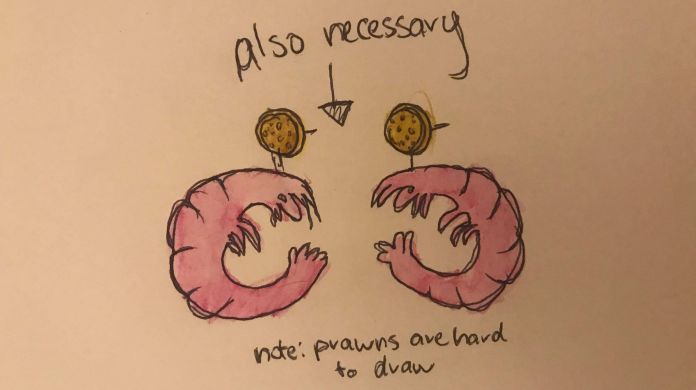

Item: Jewellery (specifically, a pair of silver earrings shaped like kangaroos, a bottle green wooden bead necklace and a pair of sparkly gold resin earrings with obnoxiously-large pink plastic prawns dangling from them)

Price: $69

What a bank would think: This person is reckless and ridiculous. Not only would she be unable to make mortgage repayments because she buys stupid stuff, but her house would be crassly decorated. Do not trust her!

Well, actually…: These accessories, which all cost less than $35 each, gives otherwise plain outfits much-needed pops of colour and personality. I’m someone who prefers a black shirt and denim shorts combo or, if I’m feeling particularly jaunty, a shit shirt and demin shorts combo. I already have the shorts that somehow make the large-hip-flat-arse arrangement I was… gifted look less odd. Black and white t-shirts are quite cheap and I already have many. These small jewellery purchases allows me to re-re-re-re-re-wear my denim shorts combos by giving them a fresh update. And this means I spend less on clothes.

So suck on that.

Item: Very fancy matches with white tips instead of red ones

Price: These were a gift so I won’t say exactly how much, but I will say it was roughly the same amount you would spend on a coffee-and-cake combo at one of the flasher cafes in the food court.

What a bank would think: This person spent how much on matches? Who does she think she is?! Beyoncé?!

Well, actually…: I bought these while at one of those fancy homewares stores, looking for a card to shove cash in for an engagement party. Cards at this shop weren’t much cheaper than the fancy, fancy matches and I figured that, since the card was essentially just a vessel for the cash gift, I may as well make that vessel something useful. So this was not a gift, per say, but a practical card alternative. And I think that shows that I am an innovative mind and a rational decision maker.

* Also, I feel ethically bound to point out that a science-loving friend of mine made the “with money to burn” joke at the end of brunch, after she explained to me where candle wax goes when it burns. She’s very clever.

Item: A Saturday morning Uber trip

Price: $25

What a bank would think: This young woman has the use of a vehicle and yet she gets chauffeured about the city like she’s in Gossip Girl? Bin her!

Well, actually…: I opted not to drive this morning because I was going to a boozy breakfast and didn’t want to risk drink driving, thank you very much. A stuffy banker may think that getting on the sauce at 9.30am is somewhat concerning, but I think my foresight to not put my own safety and the safety of others at risk suggests I’m a responsible adult who has the capacity to plan around her worrying drinking habits. Surely that’s the kind of person you want to lend money to.

Item: Mexican food for one

Price: $26

What a bank would think: Look, Mexican food is great but twenty-six bucks on a burrito is not economically sound. Also, the fact that she bought a meal for one on a Friday night suggests she is single AF and will probs be buying a house on one income.

Well, actually…: It was a fajita bowl with extra veggies, no cheese and brown rice, which is way healthier than a heaving burrito. And the fact that I was able to abstain from cheese for a TGIF take away meal not only suggests that I have the willpower needed to tackle a mortgage but that I will also live longer than someone who gets fish and chippies with their boyfie every weekend and will therefore generate more income.

Item: Groceries (specifically, four zucchini, washing up gloves, microwavable brown rice and a five-metre long extension cord)

Price: $21

What a bank would think: Look, this isn’t a lot of money, but figures show she when to the supermarket the night before and frequents the place multiple times per week. This is someone who clearly forgets things and her slippery mind will probably forget to make mortgage repayments.

Well, actually…: Yeah, you got me there. I’ve got a memory like a sieve. But now that I’ve got rubber gloves for dishwashing, the psoriasis on my hands won’t be so inflamed and weepy, making my handshakes at least 47 per cent less gross, which can only be a good thing.